Most zero-emission vehicle (ZEV) purchases are concentrated among early-adopting new vehicle buyers. Making ZEVs accessible to all drivers—including across the used vehicle market—is critical to ensuring used car buyers experience ZEV benefits and that broader environmental goals are met. This report assesses market trends, technology changes, and policies to better understand and support the used ZEV market. Specifically, this paper provides research on used ZEV prices, durability, incentives, and charging infrastructure needs to identify possible future policies for a successful used ZEV market. The conclusions lead to the following findings:

The used market provides an opportunity for more affordable ZEVs. Due to faster technology advancements, used ZEVs depreciate faster than conventional combustion engine vehicles. This dynamic results in used ZEVs reaching price parity with used conventional vehicles between the 2025-2028 timeframe. Research has also found that used ZEVs could generate substantial maintenance and fuel cost savings for drivers compared to used conventional vehicles. In the United States, five-year-old plug-in electric vehicles could save 11% to 17% in annual ownership costs relative to a comparable conventional car, and the savings increase to 17% to 22% for seven-year-old vehicles. In the United Kingdom, the ownership costs of a five-year-old used ZEV are £2,600 to £3,200 ($3,600 to $4,600) less than comparable conventional vehicles.

Small-scale programs can fill information gaps and help to refine policies to encourage the development of the used ZEV market. These programs and pilot projects could include incentives, infrastructure deployment, and targeting programs in priority areas. The data gathered from these projects can be used to identify subsequent actions involving greater scale and cost. Based on tracking of the used ZEV market, jurisdictions can expand, modify, or phase down regulations, purchasing support, and charging infrastructure programs.

Reliability requirements and assurance provision measures could increase confidence and demand for used ZEVs. Although early evidence indicates that batteries and other components of electric vehicles have better longevity compared to conventional vehicles, many consumers are uncertain given the novelty of the technology and well-publicized issues for select models in early years. Over time, policies and regulations that aim to strengthen ZEV durability, such as longer warranties and right to repair laws, could help older ZEVs to remain on the roads for an even longer period. Measures that guaranty access to charging, especially in multifamily homes, and that maintain fast charging compatibility with older ZEV models will also be important.

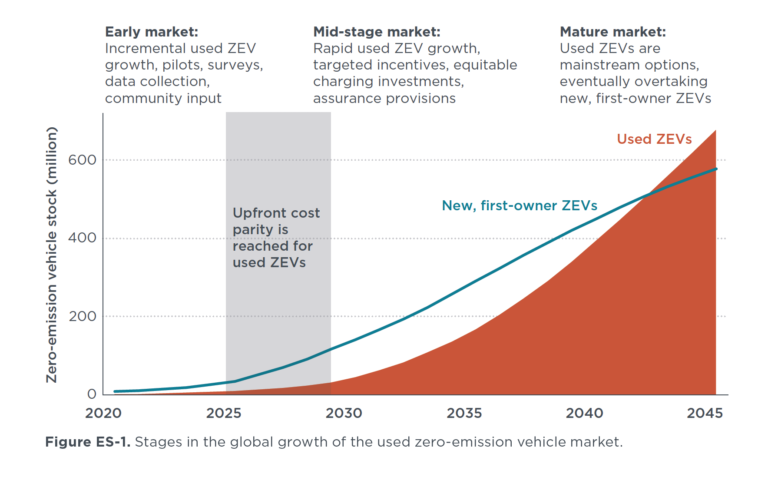

By the early 2040s, used ZEVs could surpass first-owner ZEVs. As shown in the figure below, the stock of used ZEVs remains far smaller than the stock of first-owner ZEVs until the late 2020s. Between 2028 and 2035, the population of used ZEVs increases from 23 million to 168 million, with used ZEVs reaching upfront cost parity with comparable used conventional vehicle models around 2025-2028.